Online Banking Security

As a member of Atlantic Edge Credit Union, you play an important role in protecting your personal and financial information when banking online. You can help maximize the security of your online banking activities and protect yourself against identity theft and other online fraud schemes by following safe online banking practices and by not disclosing your online banking security login information.

RSA Increased Authentication: working to better protect our members

Atlantic Edge Credit Union has implemented RSA increased Authentication features to provide more security to the login process. These features provide members with an additional layer of protection. If you are new to online banking, please login to set up the new security features. If you are an active user of online banking, this increased authentication should already be in place.

On December 5, 2018 at 5:00 a.m. a slight modification will be applied to RSA Increased Authentication which will improve member protection against malicious actors that are walking away from the login session when presented with a challenge question. Within Increased Authentication, answering the challenge questions incorrectly three times will lock the account, requiring members to contact the financial institution to unlock the account. Currently, walking away from a challenge question (being presented one and not answering) does not affect this counter. After this change, however, walkaways will be included in the counter.

Updated Security Feature for MemberDirect Online Banking

As part of our continuing commitment to cybersecurity, the reCAPTCHA safety feature has been updated for use with the MemberDirect digital banking system. Enhanced authentication practices are common place for online banking and e-commerce platforms, and login features will continue to evolve with advancements in technology. This feature confirms that members are human (and not a robot).

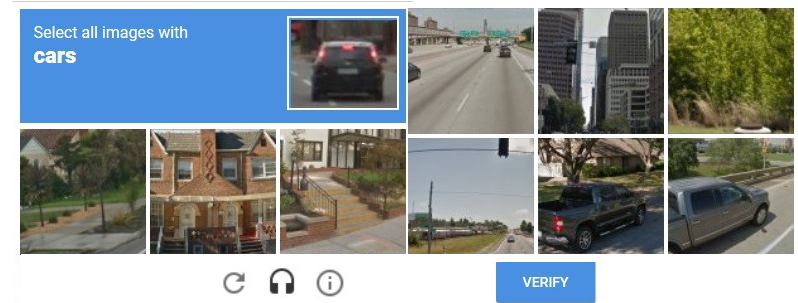

As this version of the reCAPTCHA feature runs in the background, there is no additional action required at login, unless it cannot identify whether you are a human or a robot. After you have entered your online banking information and clicked log in, there are two possibilities. Either you will proceed to the online banking page as normal or you will be given a group of images and be asked to identify and click on images that are being requested. In the example below, a member is asked to ‘Select all images with cars.’ In this instance, the member would select four images: the middle left and the three bottom images.

Once you have selected the images, press "Verify" (or "Next" if displayed). If all the required images were identified, the box will close, and you will be redirected to your Account. If you did not identify all the required images, you will be prompted to re-complete the process.

If you have any questions or concerns, we are here to help. Please contact us at:

1-877-377-3728 or email info@aecu.ca.

Need help? Visit reCAPTCHA Support.

To protect your accounts, we use reCAPTCHA technology, provided by Google. For more information, visit Google reCAPTCHA and Google Privacy.